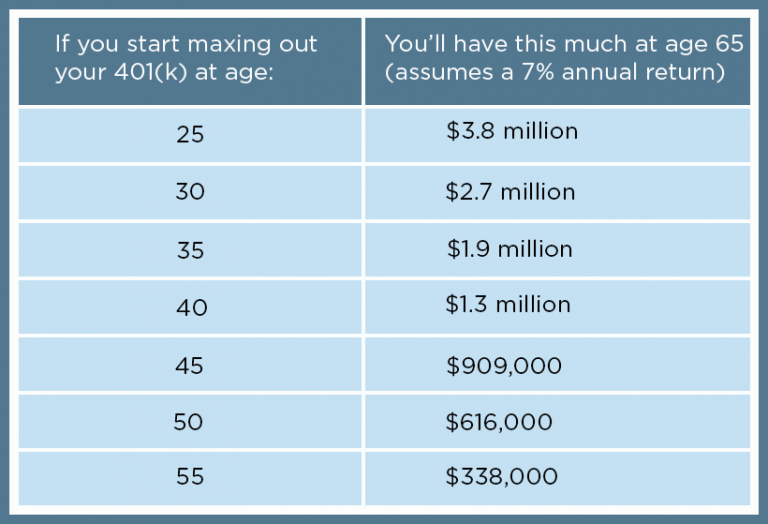

Here are three tips to contribute the most to your 401(k): 1. Maxing out your retirement account simply means contributing up to $22,500 annually. While any amount you can contribute to your 401(k) plan is better than nothing, some workers max out their accounts to set themselves up for the best financial situation in their older years. If you’re pursuing early retirement, prioritizing retirement savings in your budget is all the more important. Tips for maxing out your 401(k)Įven if retirement feels like a long way off, it’s best to start saving as early and as much as possible to ensure a comfortable retirement. The new $22,500 limit for 2023 applies not only to 401(k) plans but also to 403(b) plans, most 457 plans and certain other plans. 1 to June 30, 2023, and contribute $15,000 to Company A’s 401(k), you can contribute only $7,500 (or $15,000 for those age 50 or older) for the rest of the year in another employer’s 401(k). Here’s an example from Robert Massa, the managing director of retirement in Houston for Qualified Plan Advisors:Įxample: If you work for Company A from Jan. You can contribute up to $22,500 total to your retirement accounts. The not-so-good news is that your allowable contributions don’t change. The good news is that nothing prevents you from contributing to multiple 401(k) plans. It could be that you switch employers throughout the year, that you have more than one job that offers a retirement plan or that your employer offers more than one type of plan.

In some cases, you may have the opportunity to contribute to more than one employer-sponsored retirement plan in a year. The table below compares the various contribution limits for 2023 to those from 2022:Ĭan you contribute to more than one 401(k) plan? That amount is $73,500 if you qualify for catch-up contributions. That limit for 2023 is $66,000 or 100% of your salary, whichever is lower. Instead, the IRS sets a separate combined contribution limit for employee and employer contributions. In other words, an employer may match your contributions up to a particular percentage of your income.įurthermore, if your employer contributes to your 401(k) plan, its contributions don’t count toward your annual contribution limit. Many employers contribute to their employees’ 401(k) plans, usually in the form of matching contributions. The table below gives a more thorough breakdown. After-tax contributions - Roth contributions - are contributed after the money has been taxed, meaning you can withdraw it tax-free during retirement. Pretax contributions are taken from your paycheck before taxes are applied. Remember, this limit applies to pretax and after-tax 401(k) contributions. As a result, the total allowable contribution for someone 50 or older is $30,000 in 2023. That extra contribution is called a catch-up contribution, allowing you to contribute an additional $7,500 per year to your 401(k) plan. The IRS also allows you to invest a larger amount in your 401(k) if you’re 50 or older to account for having less time to save for retirement. Given the high inflation numbers throughout 2022, the IRS increased the limits by more than it had in recent years. The IRS revisits these numbers annually and, if necessary, adjusts them for inflation. In 2023, the IRS allows you to contribute up to $22,500 to your 401(k) plan, up from $20,500 in 2022. The 401(k) contribution limits can be broken down into two types: the employee contribution limit and the combined employee and employer contribution limit.

So if you’re planning to save for retirement with this type of account, it’s important to understand how much you can contribute and some other ways to save for retirement in addition to your 401(k). They also grow tax-deferred until you withdraw the money during retirement.Įven better, many companies that offer a 401(k) plan also offer a matching contribution, meaning if you contribute to your 401(k) plan, your employer will match it, usually up to a percentage of your salary.īut the IRS also limits the amount you can contribute to your 401(k) plan each year. Traditional 401(k) contributions are pretax, reducing your taxable income. The employer-sponsored 401(k) plan is one of the best ways to save for retirement, thanks to the short- and long-term tax advantages, the high contribution limits, and the potential for an employer match.Īs an employee, you can contribute up to a certain amount of your salary each year. If your employer contributes to your 401(k) plan, those contributions don’t count toward your annual contribution limit.You can contribute to more than one 401(k) plan.

0 kommentar(er)

0 kommentar(er)